Future In Roofing Maintenance

Key Roofing Market Trends in the United States

1. Steady Re-Roofing Demand from Aging Housing Stock

A. Mordor Intelligence has said that a big driver is the re-roofing cycle: many homes in the Northeast and Midwest were built decades ago, and as they age, they’re approaching maintenance needs to full roof replacement.

B. According to Mordor Intelligence over 80% of roofing demand is from replacement activity (rather than new builds).

C. Harsh weather (freeze-thaw, ice, snow) in the region stresses roofs more than milder climates, increasing the importance of durable underlayments like ice-and-water shields per Pheonix Research on U.S. Roofing Market 2025-2033.

2. Premiumization and Resilient Roofing Materials

A. Pheonix Research has said that there is a shift from commodity-level asphalt shingles toward more premium, resilient roofing systems per their U.S. Roofing Market 2025-2033 report. A recent survey indicates a slowdown in the re–roofing market, though demand remains steady overall. This slowdown may be the effect of customers making smarter choices on the replacement material for their home.

B. In the Northeast especially, materials that can withstand snow load, wind, and ice are in demand. The Pheonix Research report explicitly notes: “resilient replacement markets” in the Northeast and Mid-Atlantic. Pheonix Research on U.S. Roofing Market 2025-2033.

C. Metal roofing is increasingly popular for its durability and long lifespan per News Channel Nebraska (ncn)

D. There’s growing adoption of energy-efficient and “cool” roofing (reflective coatings, higher solar reflectance) tied to sustainability and building code pressures. This was noted by imarc (transforming ideas into impact) in their book, “United States Roofing Market Size, Share, Trends and Forecast by Type, Roof Type, Application, and Region, 2025-2033”

3. Energy Efficiency & Sustainability Incentives

A. Mordor Intelligence has said that federal and state incentives for energy-efficient roofing (e.g., tax credits, energy code compliance) are pushing more building owners to choose higher-performance roofs—metal roofs with a special pigmented coating that meet ENERGY STAR requirements to reflect solar radiation and asphalt shingles with cooling granules that meet ENERGY STAR requirements.

-> Credit Amount: 30% of the material costs, with a maximum annual credit of $1,200 for all building envelope improvements (which includes windows, doors, and insulation).

B.

Key Requirements:

1) The credit applies to your principal residence in the United States, not new construction or rental properties.

2) Only the cost of the materials is eligible for the credit; installation costs are excluded.

3) The contractor must make sure all items used have a Manufacturer’s Certification Statement confirming the product’s eligibility, and, for items placed in service in 2025, you must include the Qualified Manufacturer Identification Number (QMID) on your tax return. Check with your tax person before starting on this credit.

C. Market Research in their report on “United States Roofing Market Growth Analysis Forecast Trends and Outlook (2025-2034); Green-building trends are boosting interest in roofs that help with insulation, energy savings, or even sustainability certifications.

D. Research and Markets Super Store disclosed their report descriptions from “United States Roofing Market Growth Analysis Forecast Trends and Outlook (2025-2034); Green-building trends are boosting interest in roofs that help with insulation, energy savings, or even sustainability certifications.

4. Insurance-Driven Roof Replacements

A. Mordor Intelligence also indicated that severe weather (hail, wind, and storms) in many parts of the U.S., including the Northeast and Mid-Atlantic is contributing to roofing claims and accelerating replacement cycles. Insurers are incentivizing more resilient roofing (e.g., impact-rated shingles) via premium credits and contractor deals.

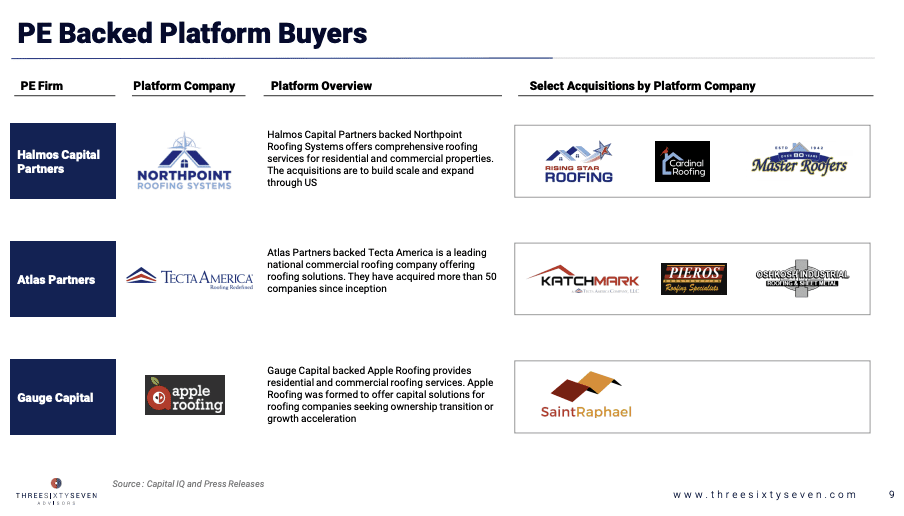

5. Mergers and Acquisitions (M&A) and the Fragmented Contractor Landscape

A. An organization called THREESIXTYSEVEN ADVISORS put out a report called “Us Residential & Commercial Roofing Market” by 367 advisors to present the residential and commercial roofing market. The bottom-line: The roofing contractor market remains highly fragmented, especially in residential. Private equity and strategic consolidations are rising. Mid-sized roofing companies are being rolled up, and larger platforms are expanding their geographic footprint. Distribution is also evolving: companies like Home Depot and QXO are leveraging distribution scale and technology to serve contractors more efficiently.

B. Major roofing supply companies continue to grow through acquisitions.

ABC Supply acquired Roofing Supply – Houston, and Nations Roof acquired Boone Brothers Roofing. Private equity continues to challenge the market, because a recent collapse of a large, private, equity-backed roofing company highlights the risks of the “roll-up” strategy. The market has seen a significant number of private equity acquisitions, but many haven’t paid off as expected, particularly as the housing market and interest rates have presented challenges.

C. Ethical Exteriors is a mid-sized,independent roofing contractor in Michigan with a network that supports most of Eastern Michigan. Our goal is to provide each customer with superior services with high-quality materials and excellent skilled workers including a team leader that manages each jobsite exceptionally well. Our Mission Statement is to provide each customer with ethically performed services, value pricing and 100% quality.

6. Labor Constraints

A. Skilled labor shortages continue to be a challenge. Many roofing firms struggle to recruit and retain qualified workers, especially given the physically demanding, seasonal nature of roofing.

7. Digital & Technological Adoption

A. Roofers are increasingly using digital tools such as drone-based assessments (for damage inspections) to help speed up claim assessments and roof condition diagnostics.

B. There is a rising interest in “smart” or integrated roofs: systems that integrate solar or monitoring capabilities are part of the long-term innovation pipeline.

C. Roofing services are increasingly emphasizing high-quality installation, safety, and compliance (especially as building codes tighten and clients demand more durable solutions).

Recent Posts